In recent years, the use of AI in retail banking has surged, profoundly reshaping the landscape of this essential sector. As technology advances, banks are increasingly leveraging artificial intelligence to enhance customer experiences, streamline operations, and bolster security measures. This article delves into the myriad ways AI is revolutionizing retail banking, offering insights into its benefits and potential challenges.

The Role of AI in Retail Banking

At the heart of modern banking, AI plays a pivotal role in transforming how banks interact with their customers and manage their internal processes. From chatbots to risk assessment, AI technologies are becoming integral in delivering efficient and personalized banking services.

Enhancing Customer Experiences

One of the primary applications of AI in retail banking is enhancing customer experiences. AI-powered chatbots, for instance, are available 24/7, providing immediate assistance to customers and resolving queries without the need for human intervention. This not only improves customer satisfaction but also reduces operational costs for banks.

Streamlining Operations

Retail banks are utilizing AI to streamline their operations. By automating routine tasks such as data entry and transaction processing, banks can allocate resources more efficiently and focus on strategic decision-making. This operational efficiency is crucial for banks to remain competitive in the fast-paced financial sector.

AI and Security in Retail Banking

Security is a paramount concern for banks, and AI is instrumental in bolstering their defenses against fraud and cyber threats. AI algorithms can analyze vast amounts of data to detect unusual patterns and potential security breaches, allowing banks to respond swiftly and mitigate risks.

Fraud Detection and Prevention

AI-driven systems are capable of identifying fraudulent activities in real-time, significantly reducing the likelihood of financial losses. By continuously monitoring transactions, AI can flag suspicious behavior and alert bank officials, who can take appropriate actions to prevent fraud.

Enhancing Cybersecurity

In addition to fraud detection, AI enhances cybersecurity protocols in retail banking. Machine learning algorithms can predict and prevent cyber attacks by analyzing patterns and recognizing potential vulnerabilities. This proactive approach strengthens the overall security infrastructure of banks.

The Future of AI in Retail Banking

As we look to the future, the integration of AI in retail banking is set to deepen, with more innovative applications on the horizon. Banks are exploring advanced AI technologies such as machine learning, natural language processing, and predictive analytics to further enhance their offerings.

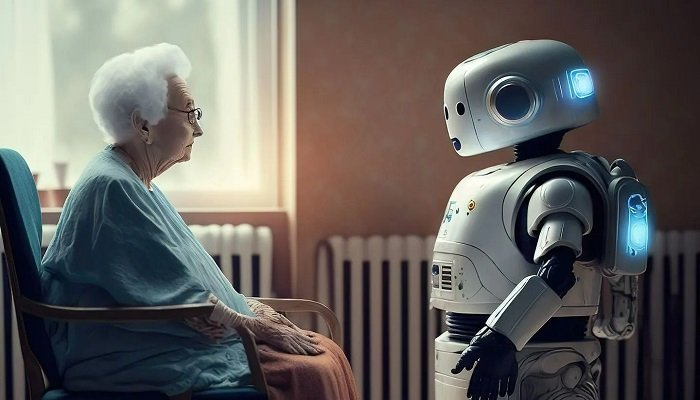

Personalized Banking Services

In the coming years, AI will enable banks to offer highly personalized services tailored to individual customer needs. By analyzing customer data, banks can provide personalized financial advice, product recommendations, and tailored offers, enhancing customer loyalty and engagement.

Integration with Emerging Technologies

The integration of AI with emerging technologies like blockchain and the Internet of Things (IoT) holds immense potential for retail banking. By combining these technologies, banks can enhance transparency, streamline processes, and offer innovative services to their customers.

For more insights into the intersection of AI and blockchain in the financial sector, you can visit this AI and Blockchain in Finance article.

Challenges of Implementing AI in Retail Banking

While the benefits of AI in retail banking are significant, there are challenges that banks must navigate to fully realize its potential. These include data privacy concerns, the need for skilled talent, and regulatory compliance.

Data Privacy and Security

As banks leverage AI technologies, ensuring the privacy and security of customer data becomes paramount. Banks must implement robust data protection measures and comply with regulations to maintain customer trust.

Talent Acquisition and Training

The successful implementation of AI requires skilled professionals who can develop, deploy, and manage AI systems. Banks must invest in talent acquisition and training to build a workforce capable of harnessing the full potential of AI technologies.

Conclusion

The integration of AI in retail banking is transforming the industry in unprecedented ways. By enhancing customer experiences, streamlining operations, and bolstering security, AI is paving the way for a more efficient and customer-centric banking environment. As banks continue to embrace AI, they must remain vigilant in addressing the challenges while exploring new opportunities to innovate and grow.

FAQs

What is the role of AI in retail banking?

AI plays a crucial role in enhancing customer experiences, streamlining operations, and improving security in retail banking.

How does AI enhance security in retail banking?

AI enhances security by detecting fraud, predicting cyber threats, and strengthening cybersecurity protocols.

What are the challenges of implementing AI in retail banking?

The challenges include data privacy concerns, talent acquisition, and regulatory compliance.